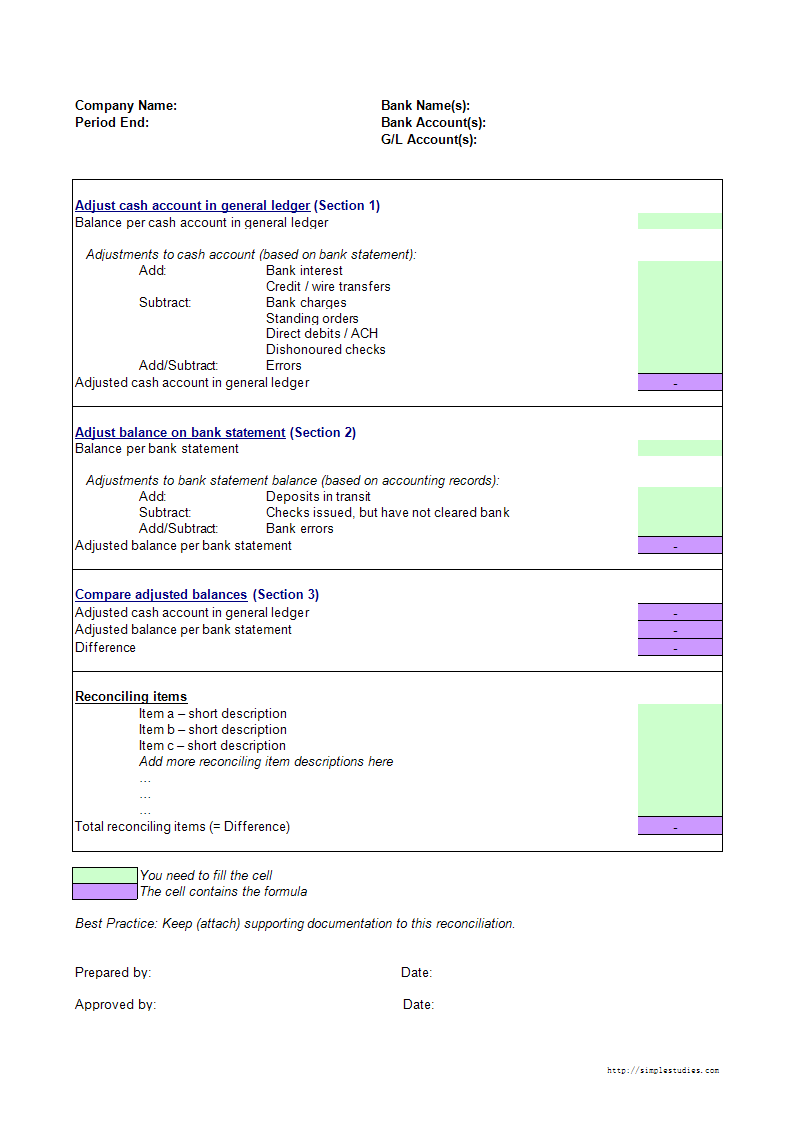

Checking account reconciliation form number total ending balance shown on statement plus deposits not shown on statement sub total less total outstanding drafts equals adjusted ending balance adjusted ending balance shown above should agree with the balance shown in your check book. The reason for this is that there may be a delay between the time you have made a deposit at the bank and the time your deposit has been posted as an addition to your bank account.

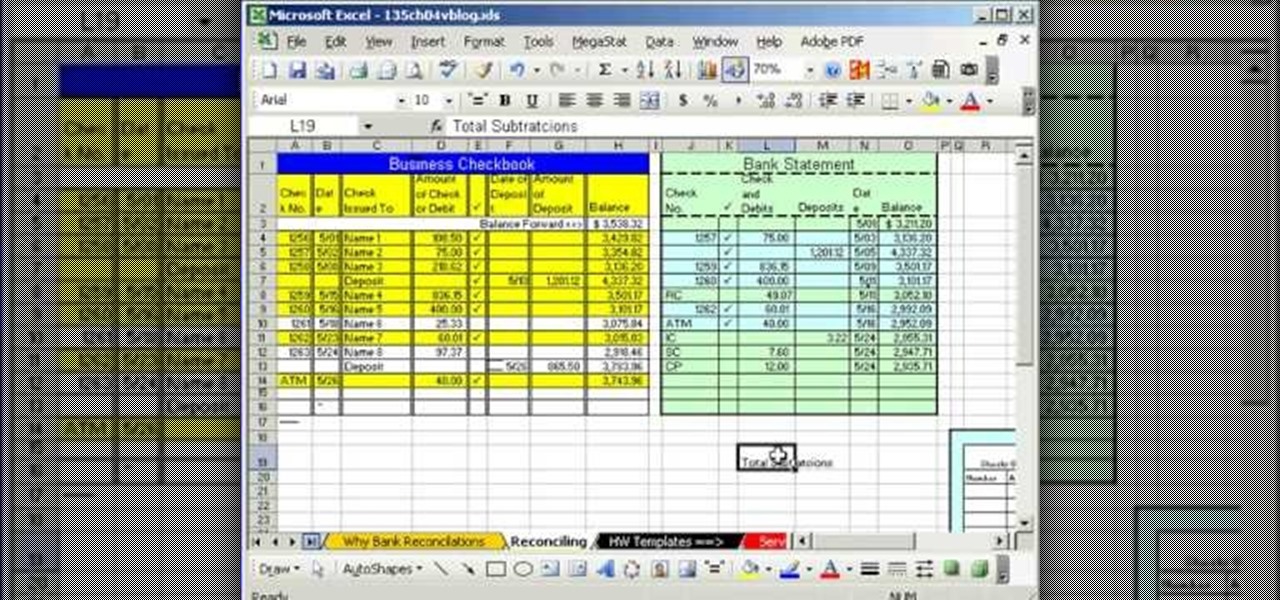

Add your own line items to this excel sheet and the template will automatically calculate the totals.

Checking account reconciliation form template. Traditionally youd get that number from your monthly statement but you can also get an up to the minute balance online theres still value in balancing your account even if you can see an account balance 247. Dont forget to include debit card transactions. Any of the templates above will help you do that.

With these templates you can easily adjust the difference between the cash balance reflected in the statement and the amount displayed in the bank account holders name. To get started grab your most recent account balance. The template includes lines for assets such as cash accounts receivable inventory and investments along with liabilities including accounts payable loans and payroll.

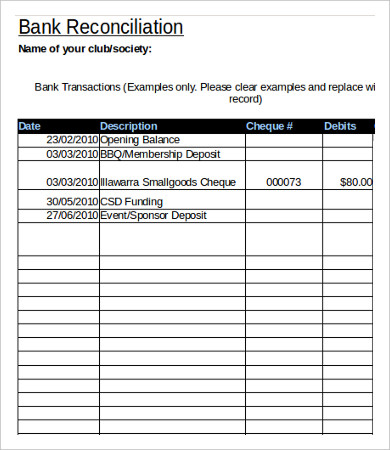

This template allows the user to reconcile a bank statement with current checking account records. A bank reconciliation is a check between your records or your companys and the banks records. Download this bank reconciliation template and incorporate it into your month end close process.

Going through the bank reconciliation process can identify errors and unrecorded transactions. The document allows you to quickly organize the bank reconciliation process. If you are using one or more accounts for spending your money then spreadsheet123s checkbook register template can help in giving a clear sense how much money you have at any point of time and also watch the expense heads.

You can also enter bank deposits and bank withdrawals. This is an accessible template. Step 1 write in the ending balance shown on your statement step 1 balance.

A perfect bank reconciliation template can assist you in the accounting task by letting you record the capital entering and leaving the account. Balancing your checkbook worksheet make sure your checkbook register is up to date with all transactions whether they are on your statement or not. It is a necessary control for every cash account.

You can enter your checking account information such as date and statement balance. You can use this template to keep a track of all your income and expenditures and all other transactions happening including withdrawals deposits bill payments fees charges etc. The spreadsheet will automatically total outstanding checks and deposits.

Prepare your bank reconciliation form first by adding onto the bank balance to make up for any deposits which may not have been recorded or posted yet. Be sure to deduct any charges fees or withdrawals.

0 Response to "Checking Account Reconciliation Form Template"

Post a Comment