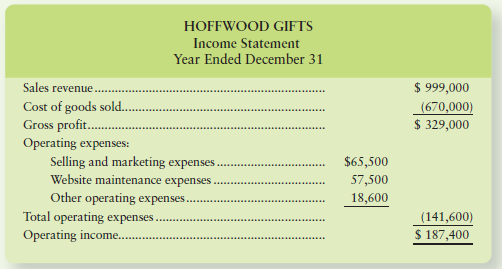

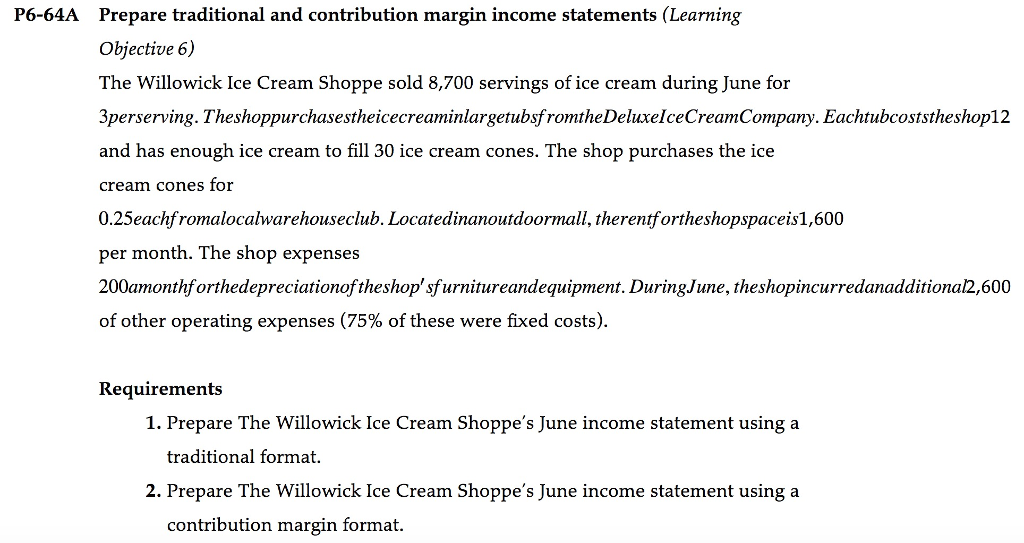

Calculating your contribution margin. A traditional income statements or profit or loss accounts prepared for external parties like govt.

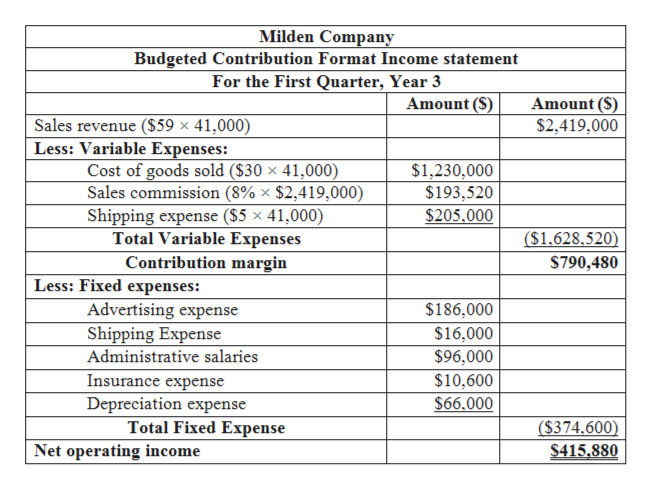

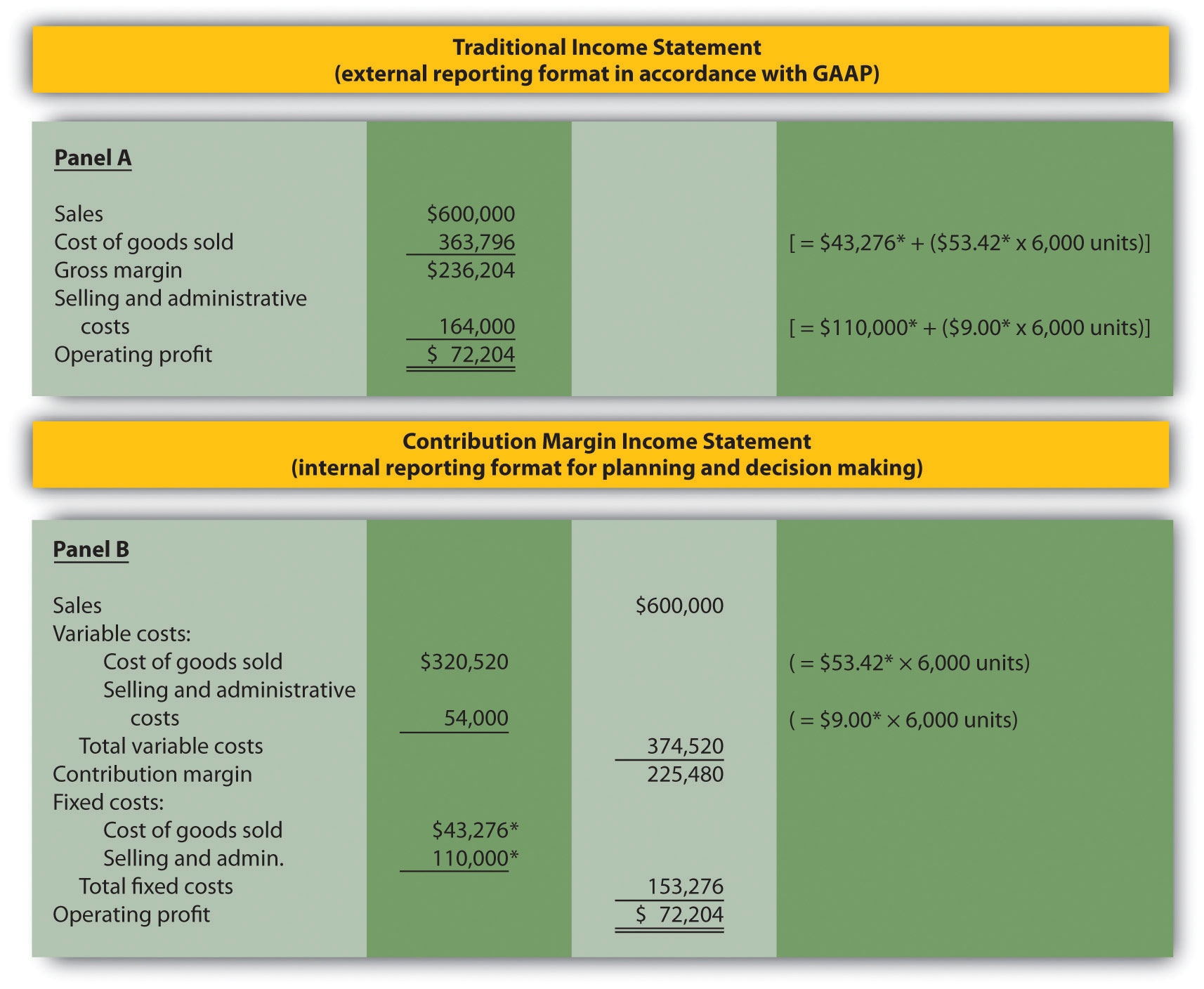

A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or net loss for the period.

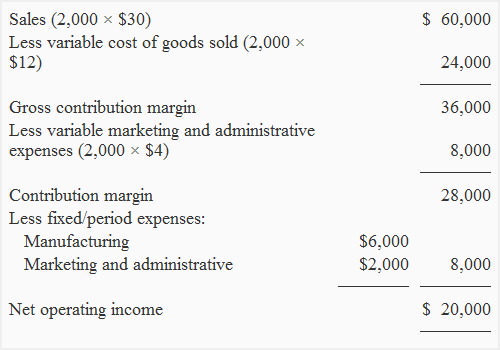

Contribution margin income statement template. Variable cost per unit is 2 per unit. Contribution margin per unit formula would be selling price per unit variable cost per unit 6 2 4 per unit. Analyze a cm statement with a data table in ms excel how to.

If there are any earnings remaining the difference is considered profit. Thus the arrangement of expenses in the income statement corresponds to the nature of the expenses. To do this youll need your sales revenue and variable cost information.

Agencies shareholders auditors show gross profit and net profit and do not show contribution margin figure. It shows the revenue generated after deducting all variable and fixed expenses separately. Contribution margin income statement is an income statement that is prepared to show the contribution margin figure in the income statement.

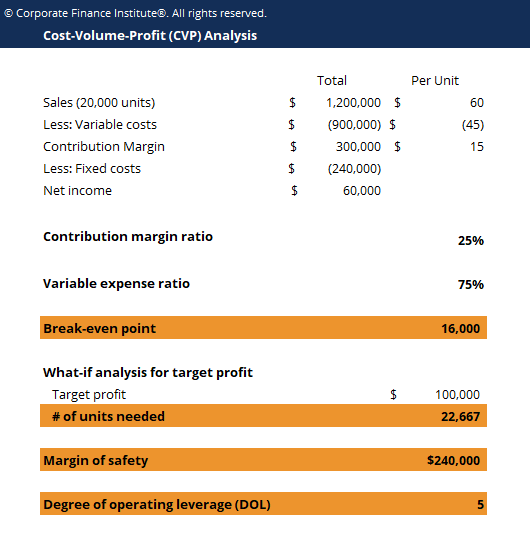

A contribution margin income statement on the other hand is a purely management oriented format of presenting revenues and expenses that helps in various revenues and expense related decision making processes. A products contribution margin is the unit price minus all associated variable costs per unit. The resulting contribution dollars can be used to cover fixed costs such as rent and once those are covered any excess is considered earnings.

Use the confidencet function in microsoft excel 2010. Contribution margin income statement. Use mixed cell references in formulas in ms excel how to.

Contribution margin is a business sales revenue less its variable costs. A contribution margin income statement is a special format of the income statement that segregates the variable and fixed expenses involved in running a business. Calculate income tax payroll deductions in ms excel how to.

Income statement templates are print ready tools that companies can use to record present and analyze the operation of the businesses for a given period usually one financial year. Companies can use the overall results to find the net profit or loss incurred for the period ended at the end of the year. A companys total contribution margin includes all earnings available to pay for fixed expenses.

The income statement is generally a record of income received and expenses incurred over that period. Contribution would be 4 50000 200000. Contribution margin ratio formula would be contribution sales 200000 300000 23.

What is the contribution margin income statement. The variable costs will include relevant variable administrative costs and any variable cost related to production. Contribution margin presented as a or in absolute dollars can be presented as.

The first step in creating your contribution margin income statement is to calculate the contribution margin.

0 Response to "Contribution Margin Income Statement Template"

Post a Comment