Continue reading below for tips on writing thank you notes information about donation receipts and links to other resources. Under this rule a person may make ten 10 trips to donate clothes and claim it as a tax deduction without proof or a receipt.

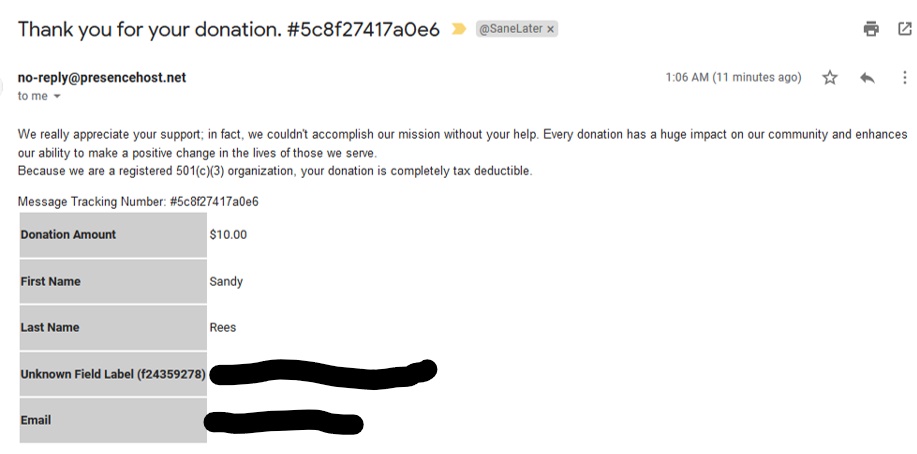

Donors need donation receipts if they want to claim charitable donations on their tax refundsfurthermore if a donation exceeds 250 the donor must obtain written acknowledgement of the donation from a charity before claiming a charitable contribution on their federal income tax return.

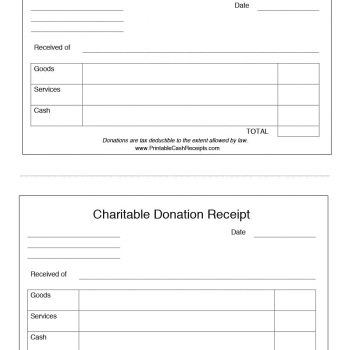

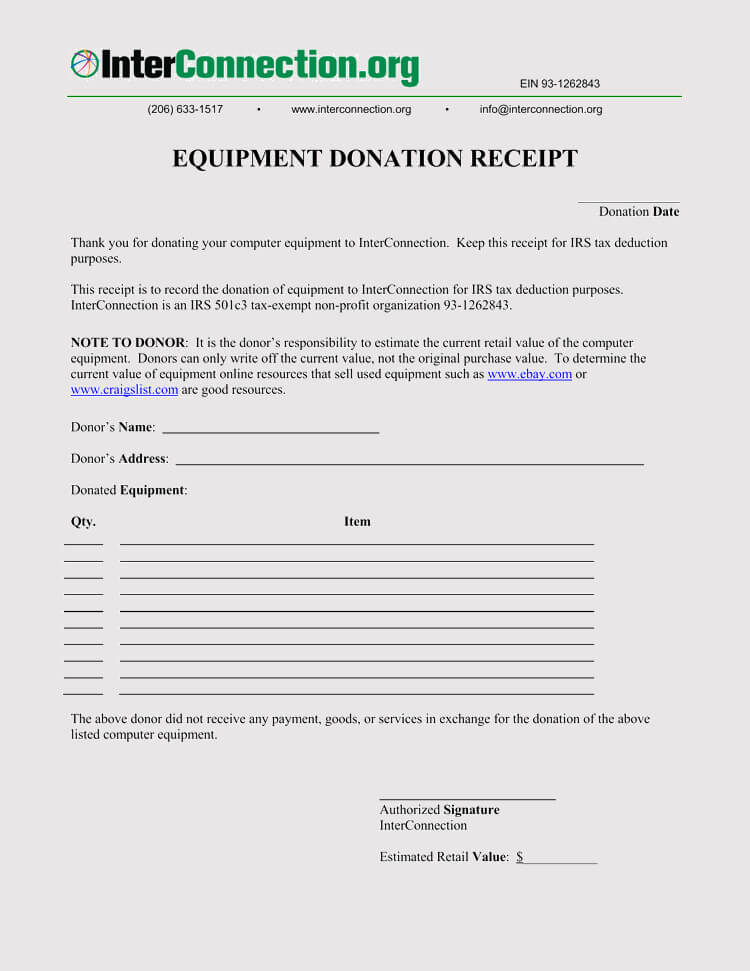

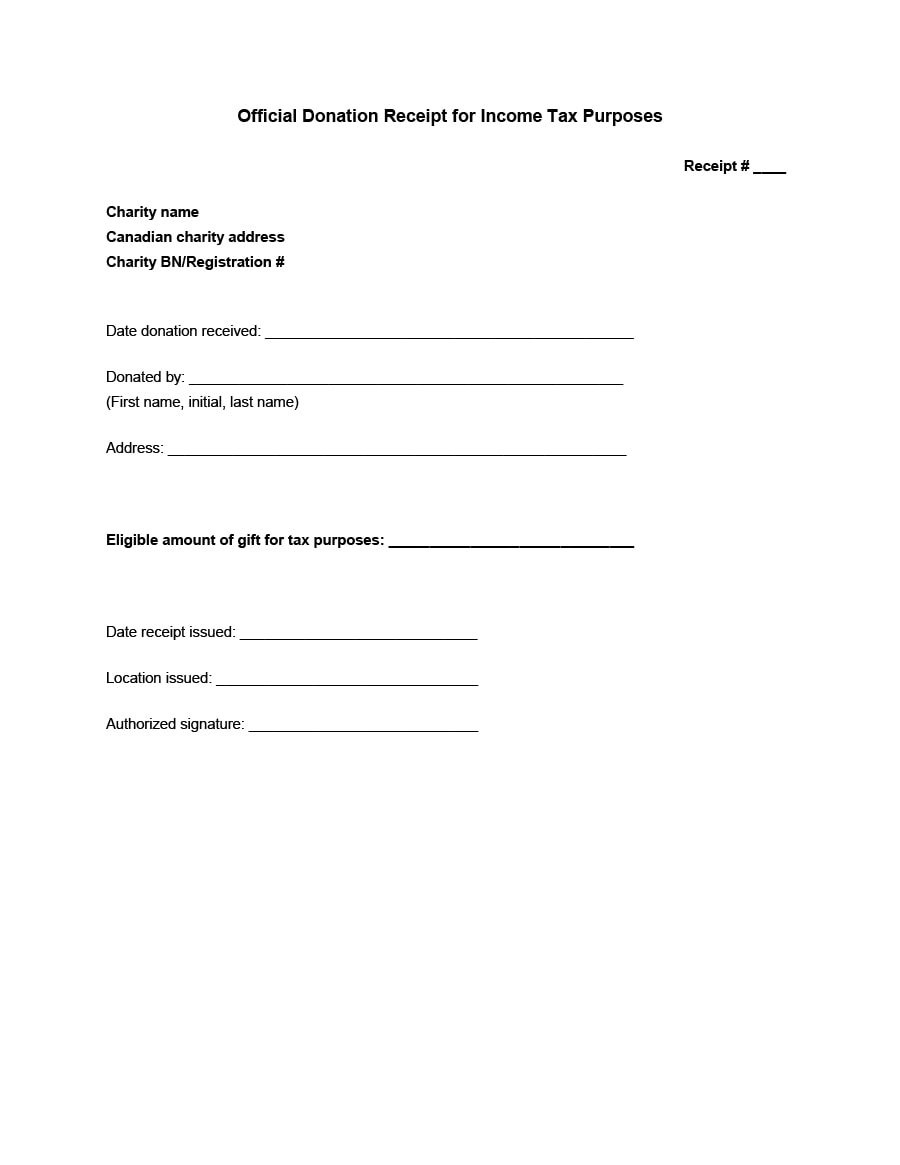

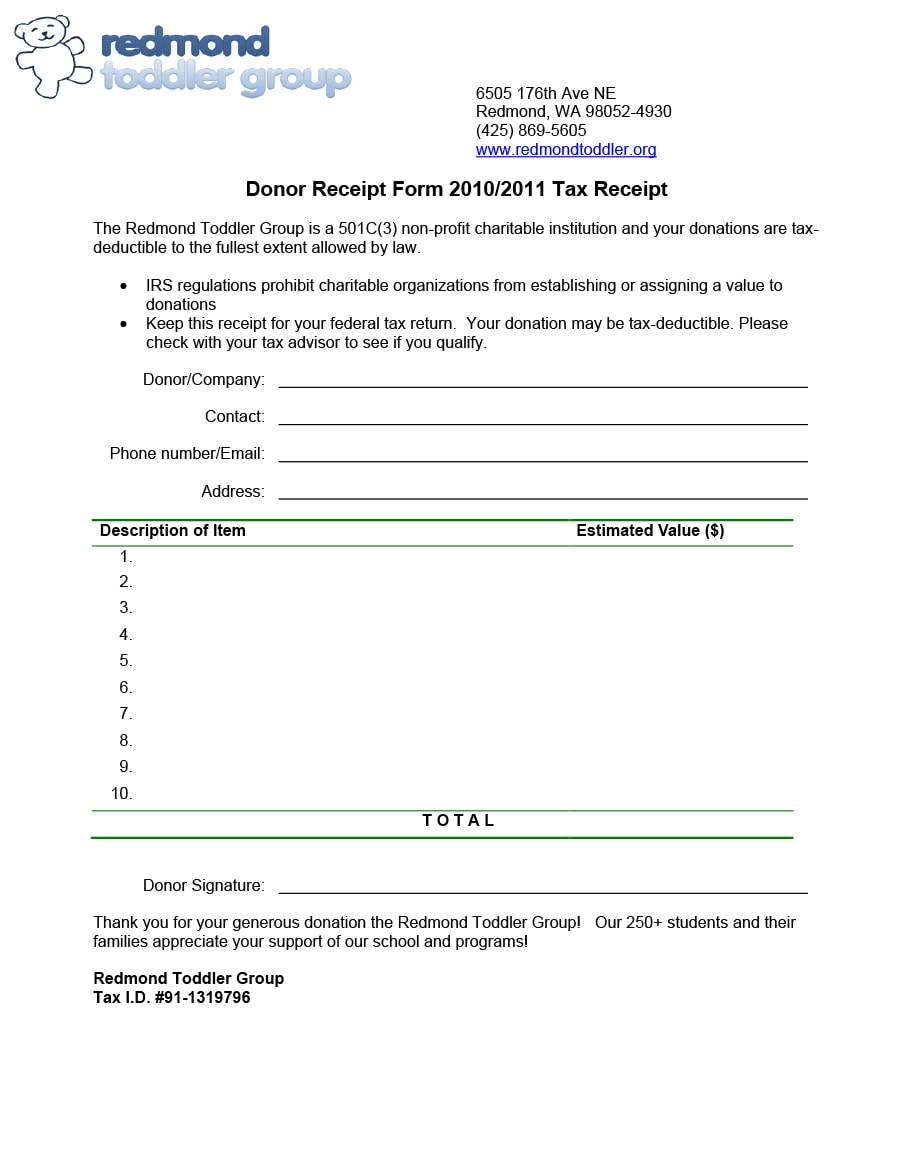

Charitable donation receipt letter template. Simply select the template desired. Nonprofits have certain requirements to follow including providing donors with a donation receipt often called an acknowledgment letter. Charitable contributions written acknowledgments internal revenue service.

Any single instance where a donation is made up to 250 does not need a receipt. Donation receipt sample letter is the acknowledgment letter for receiving the amount of donation that you asked for either in the form of money or in kind. By using this donation receipt template you can.

The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. This charitable donation receipt template helps you create donation receipts easily and quickly.

A donor acknowledgment letter is more than just a thank you letter. Best practices for creating a 501c3 tax compliant donation receipt. The templates were designed with word and excel which makes the templates easy to customize with your own organizational details logo and more.

Learn what needs to be included in this letter. Using a donation receipt template. Put your charity organization name and logo.

There are additional rules for donors if a vehicle donation is involved. Once the amount for any donation reaches 250 or more a receipt is required. To put it simply.

What is a donor acknowledgment letter. A donation thank you letter can also double as the official donation receipt that the donor will need if they are going to claim their donation as a tax deduction see the irs guidelines. Charitable donations without a receipt.

The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. This is a letter thanking the person or the organization and at the same time acknowledging the person that you have received the needful. Often a goodwill donation receipt is presented as a letter or an email which is given or sent to the benefactor after the donation has been received.

The donation receipt template is very easy to use. To place it simply donation receipts are concrete proof or evidence that a benefactor had made a contribution whether in kind or monetary to a group association or organization. The receipt template is a microsoft word document so that you can customize everything to meet your needs.

0 Response to "Charitable Donation Receipt Letter Template"

Post a Comment